Salutations, Olio aficionados! 👋

Midweek greetings to all, as we unveil the 183rd chapter of Weekly Olio—a delightful concoction of laughter, insight, and a sprinkle of mystery. Within these pages, you'll discover a handpicked selection of fascinating finds from the vast realms of the internet.

Keep your eyes peeled for this week’s Publisher’s Parmesan, arriving this Sunday!

A word from our Sponsors…

Rank #1 on Amazon—Effortlessly with Micro-Influencers!

Stack Influence automates micro-influencer marketing to boost your Amazon ranking and revenue. Trusted by brands like Unilever and Magic Spoon, our platform drives external traffic and authentic content at scale, effortlessly.

The Quote 💭

“Courage is not the absence of fear, but rather the assessment that something else is more important than fear.”

The Tweet 🐦

Over 300,000 people will go to the F1 Dutch Grand Prix this year, but none will use a car to get there. Instead, they will use trains and bicycles to reach the race track. Also, they can recycle up to 75% of the plastic cups through a fun, game-like system. Read more to find out why the Dutch Grand Prix is one of the most eco-friendly sports events in the world.

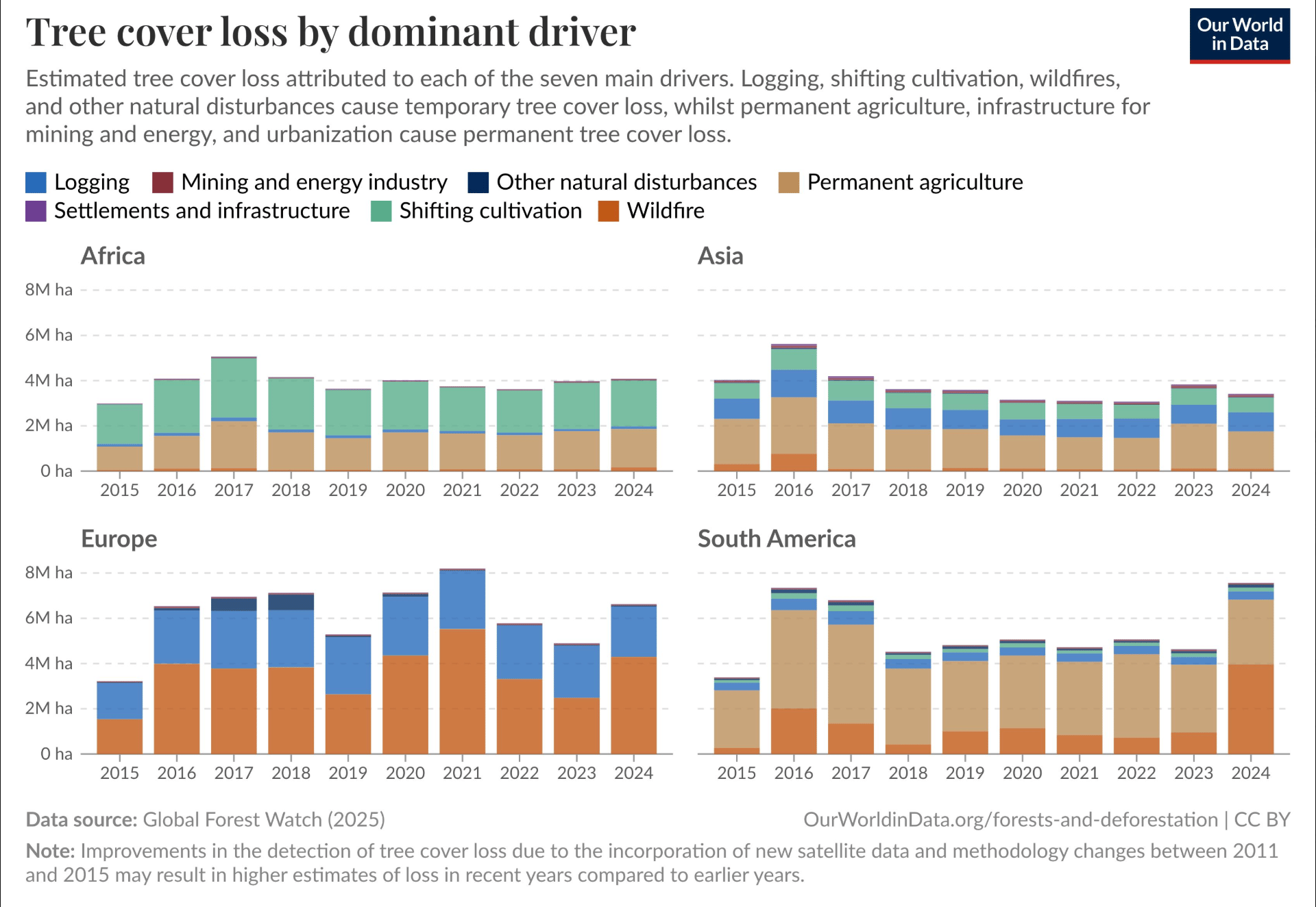

The Infographic 💹

Permanent agriculture and wildfire are the top two reasons behind loss of tree cover globally. While wildfires are the dominant reason in Europe, agriculture is the primary factor everywhere else.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

The Short Read 📝

Chinese EV makers are cashing in on Western luxury knockoffs - by Rest of World

As the electric vehicle industry in China grows worldwide, copying designs is changing the competition. Jaecoo's new J7 hybrid looks a lot like the Range Rover Evoque, and the designer admits it was inspired by it. Chinese brands often imitate Western luxury cars, and they rarely face legal action. However, increasing criticism at home and their global growth might push them to create more original designs.

Chinese car companies often copy designs as they aim to sell in other countries, according to design experts. When cheaper brands offer very similar cars at much lower prices than luxury brands, it hurts the high-end manufacturers. They lose their ability to set high prices and maintain a unique brand image, leading to price cuts across the industry that don't help anyone. Read more…

The Long Read 📜

Breaking Down Onlyfans’ Stunning Economics - by Matthew Ball

OnlyFans is a more successful business than many people realize. In this article, Matthew Ball examined OnlyFans' financial information from 2023 and found surprising figures. Known for its adult content creators, the platform made $6.3 billion in total revenue in 2024, which is almost five times more than the $300 million it made five years ago. This rapid growth is driven by increased brand recognition, the presence of well-known creators, and strict content rules on other social media sites.

OnlyFans is second only to YouTube when it comes to paying creators, and its payouts are similar to or even bigger than those in many professional sports leagues, though there is a big gap in earnings. The platform has 4.1 million creators, but most of the money goes to the top earners. The top 10% of creators make 73% of the total revenue, and the top 0.01% earn over $1 million each year. One of the main attractions of OnlyFans is that creators keep 80% of their earnings, which lets them make more money and have more control compared to traditional adult entertainment. Read more…

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

That’s all for this week. If you enjoyed this edition, we’d really appreciate if you shared it with a friend, family member or colleague.

We’ll be back in your inbox 2 PM IST next Wednesday. Till then, have a productive week!

Disclaimer: The views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group or individual.