Salutations, Olio aficionados! 👋

Welcome to the 152nd edition of Weekly Olio. We’re thrilled to introduce a fresh new twist to your Sundays: Publisher Parmesan, our hand-picked, thoughtfully crafted edition designed to spark inspiration and insights for the week ahead.

It’s the perfect way to unwind, recharge, and prepare for the week with something truly worth savoring.

If you’re new here and you’re looking for more long-form, crispy writing, click the link to subscribe under this GIF 👇

A word from our Sponsors…

Hiring IT becoming a headache?

IT hiring doesn’t have to be a hassle. Let Crossbridge take care of it all—from sourcing top talent to seamless onboarding and more. Get fully vetted resumes in just 24 hours, all handled by real people, not algorithms. Experience the Crossbridge difference.

Can India Have Its Own Zillow?

Imagine you’re searching for a home in Mumbai. You scroll through multiple listings across 99acres.com, Housing.com, and MagicBricks.com, but the experience feels frustrating. The photos are low-quality, prices seem inflated, and there’s little clarity on whether a listed price reflects actual market value or just a random number set by the seller.

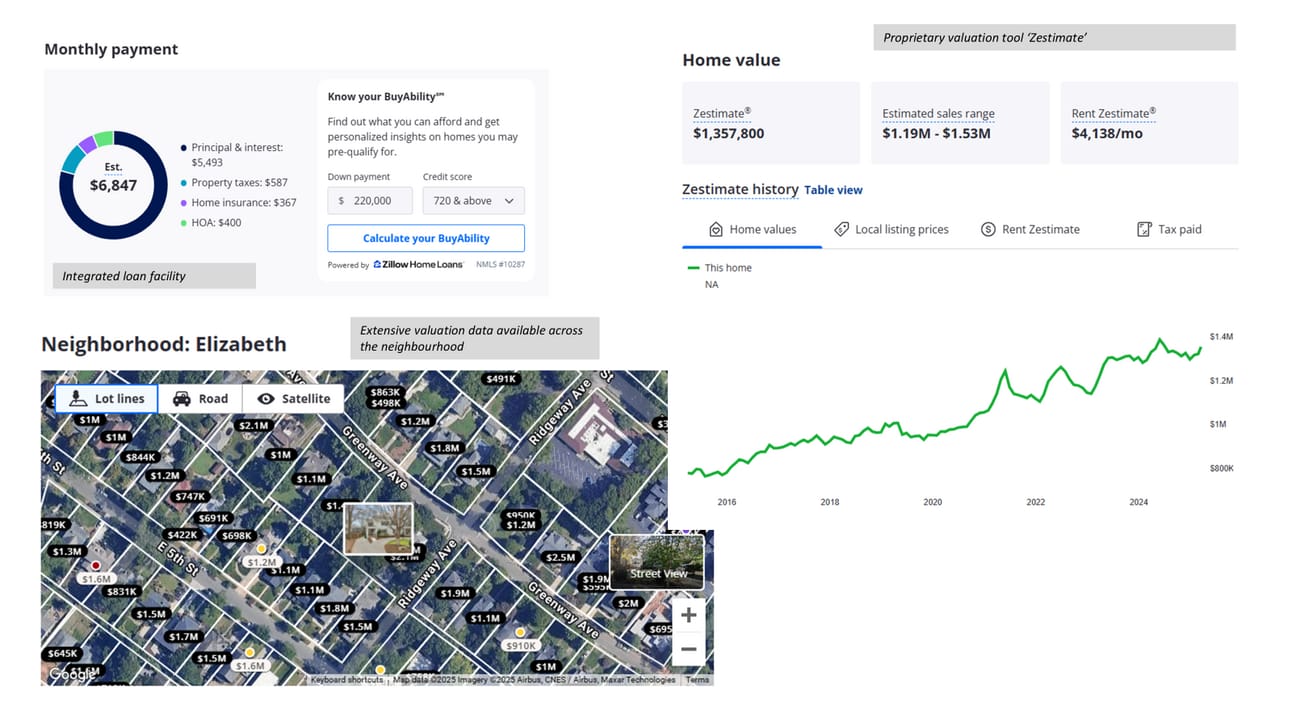

Now, contrast this with Zillow.com, the gold standard of real estate platforms in the U.S. On Zillow, you can view high-resolution images, historical price trends, property tax records, estimated home values (via Zestimate), and even secure financing—all on a single platform. The difference is night and day.

Despite the booming Indian real estate market, no platform has been able to replicate Zillow’s success. Why? And more importantly, what would it take to build a Zillow for India?

Today, India has several popular real estate platforms, each with its own strengths and weaknesses. A quick look at the numbers shows (based on semrush):

99acres (owned by Info Edge, founded in 2005) leads in traffic with 14.8 million monthly visits.

NoBroker (founded in 2014) specializes in rental listings with 10.2 million visits.

Housing.com (merged with PropTiger in 2017) is known for its better UI/UX and offers valuation tools.

MagicBricks (owned by Times Internet) has 9.6 million visits but suffers from intrusive ads that degrade the user experience.

Square Yards is a relatively smaller player, focusing on being a channel partner for property sales rather than a pure marketplace.

On paper, Housing.com emerges as the strongest contender, thanks to its superior user experience, valuation tools, and registry records integration. However, it still lacks many of Zillow’s most powerful features—particularly those related to pricing transparency, transaction integration, and high-quality listing standards.

Why Zillow works in the U.S. but not in India?

To understand why Zillow hasn’t been replicated in India, we need to look at the key structural differences between the two markets.

1. The MLS Factor: India’s Biggest Roadblock

Zillow thrives because of the Multiple Listing Service (MLS)—a centralized database where all property listings, transactions, and pricing data are standardized and regularly updated. This allows Zillow to:

Show accurate historical price trends for every property

Display real transaction prices, not just seller-set listing prices

Offer reliable valuation tools like Zestimate, which factors in past sales, demand trends, and tax records

In India, no such MLS exists. Instead, real estate data is fragmented across different state registries, builder websites, and broker databases, making it nearly impossible to consolidate and verify property prices accurately.

“In India, transaction records are scattered across state registries, making verification difficult. Some states don’t share data, others provide only unstructured PDFs.”

2. Pricing Opacity: The Trust Deficit in Indian Real Estate

If you browse an Indian real estate platform today, you’ll likely notice that listing prices are arbitrary. There’s no way to tell if the seller has inflated the price, whether the home was previously listed at a lower rate, or how much similar properties have actually sold for.

Unlike in the U.S., where Zillow shows precise historical pricing for individual properties, Indian platforms only offer general neighborhood trends. This lack of transparency:

Creates a trust deficit between buyers and sellers

Encourages price manipulation by brokers and developers

Makes valuation tools unreliable, since listed prices ≠ transaction prices

“All these platforms have tried to provide price trends. But there’s a huge gap between listed, transaction, and registry prices, making it hard to arrive at a reasonable valuation.”

3. Real Estate in India is Still Broker-Driven

Even platforms like NoBroker, which promise direct owner-to-buyer transactions, still end up relying on brokers in many cases. This is because:

Most buyers in India don’t trust online-only transactions and prefer a broker’s guidance.

Developers and agents dominate listings, making it difficult for direct owner sales to gain traction.

Unlike Zillow, which allows people to buy, sell, and finance a home in one place, Indian platforms primarily act as lead-generation businesses for agents and builders.

As a result, real estate transactions in India still happen offline, limiting the effectiveness of online platforms.

Business news as it should be

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

What would it take to build Zillow for India?

Despite these challenges, a Zillow-like platform is possible—but it would require bold structural changes and technological innovation. Here’s how it could be done:

1. Build a Trusted Data Infrastructure

The first step is to create an MLS-style database for India, aggregating data from:

Government land records (post-RERA registrations)

Builder disclosures (to track new project pricing)

Actual transaction prices from registries (where available)

This would require partnerships with government bodies, similar to how Zillow collaborates with county offices in the U.S. While challenging, this data standardization is essential for bringing transparency to Indian real estate.

“Truva.in is trying to build granular data for Indian real estate, but they’re restricted to select micro-markets like Mumbai for now.”

2. Improve Listing Quality & Standardization

A Zillow-like platform in India must ensure high-quality listings by:

Requiring high-resolution, professionally shot images (similar to Airbnb)

Offering 3D virtual tours and floor plans

Standardizing property descriptions and removing duplicate listings

This would significantly improve buyer experience and trust, making online property searches more effective.

3. Introduce a Zestimate-Like Valuation Tool

A home valuation tool for India would need to:

Factor in registry data, builder prices, and market demand

Use AI to estimate real transaction prices vs. listed prices

Provide automated pricing insights for buyers and sellers

This alone would be a game-changer, as it would remove pricing ambiguity and allow for smarter property decisions.

4. Move Beyond Lead Generation to Full Transactions

For a true Zillow-like experience, a real estate platform in India would need to:

Enable direct property transactions—allowing buyers to book and pay online

Offer integrated home loans, rather than just generating leads for banks

Provide legal verification & title records, ensuring property authenticity

This shift from a discovery-based model to a transaction-driven platform could completely disrupt the industry.

But, is India ready for a Zillow?

The dream of an India-specific Zillow is achievable, but it requires deep structural changes, regulatory cooperation, and advanced technology integration.

Who could build it?

🔹 Housing.com – Strong UI/UX, registry records, but lacks price tracking.

🔹 MagicBricks – Large inventory but needs better price transparency.

🔹 A new disruptor – A startup with MLS-style data, AI-based valuation, and direct transactions could redefine Indian real estate.

Ultimately, the first company to standardize property data, provide real-time valuation, and enable seamless transactions will dominate Indian real estate.

The race to build India’s Zillow has just begun.

Never Miss Another Warm Lead With Our AI BDR

Never miss a hot lead again. Our AI BDR Ava tracks intent signals across the web—triggering perfectly timed outreach when prospects are ready to buy.

She operates within the Artisan platform, which consolidates every tool you need for outbound:

300M+ High-Quality B2B Prospects, including E-Commerce and Local Business Leads

Automated Lead Enrichment With 10+ Data Sources

Full Email Deliverability Management

Multi-Channel Outreach Across Email & LinkedIn

Human-Level Personalization

Free up your sales team to focus on high-value interactions and closing deals, while Ava handles the time-consuming tasks.

That’s all for this week. If you enjoyed this edition, we’d really appreciate if you shared it with a friend, family member or colleague.

We’ll be back in your inbox 2 PM IST next Sunday. Till then, have a productive week!

Disclaimer: The views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group or individual.