Salutations, Olio aficionados! 👋

Midweek greetings to all, as we unveil the 227th chapter of Weekly Olio—a delightful concoction of laughter, insight, and a sprinkle of mystery. Within these pages, you'll discover a handpicked selection of fascinating finds from the vast realms of the internet.

Keep your eyes peeled for this week’s Publisher’s Parmesan, arriving this Sunday!

A word from our Sponsors…

Know what works before you spend.

Discover what drives conversions for your competitors with Gethookd. Access 38M+ proven Facebook ads and use AI to create high-performing campaigns in minutes — not days.

The Quote 💭

“You aren’t advertising to a standing army; you’re advertising to a moving parade.”

The Tweet 🐦

There has been a lot of talk about AI changing how people use travel websites. Do you agree? Share your experiences with us.

The Infographic 💹

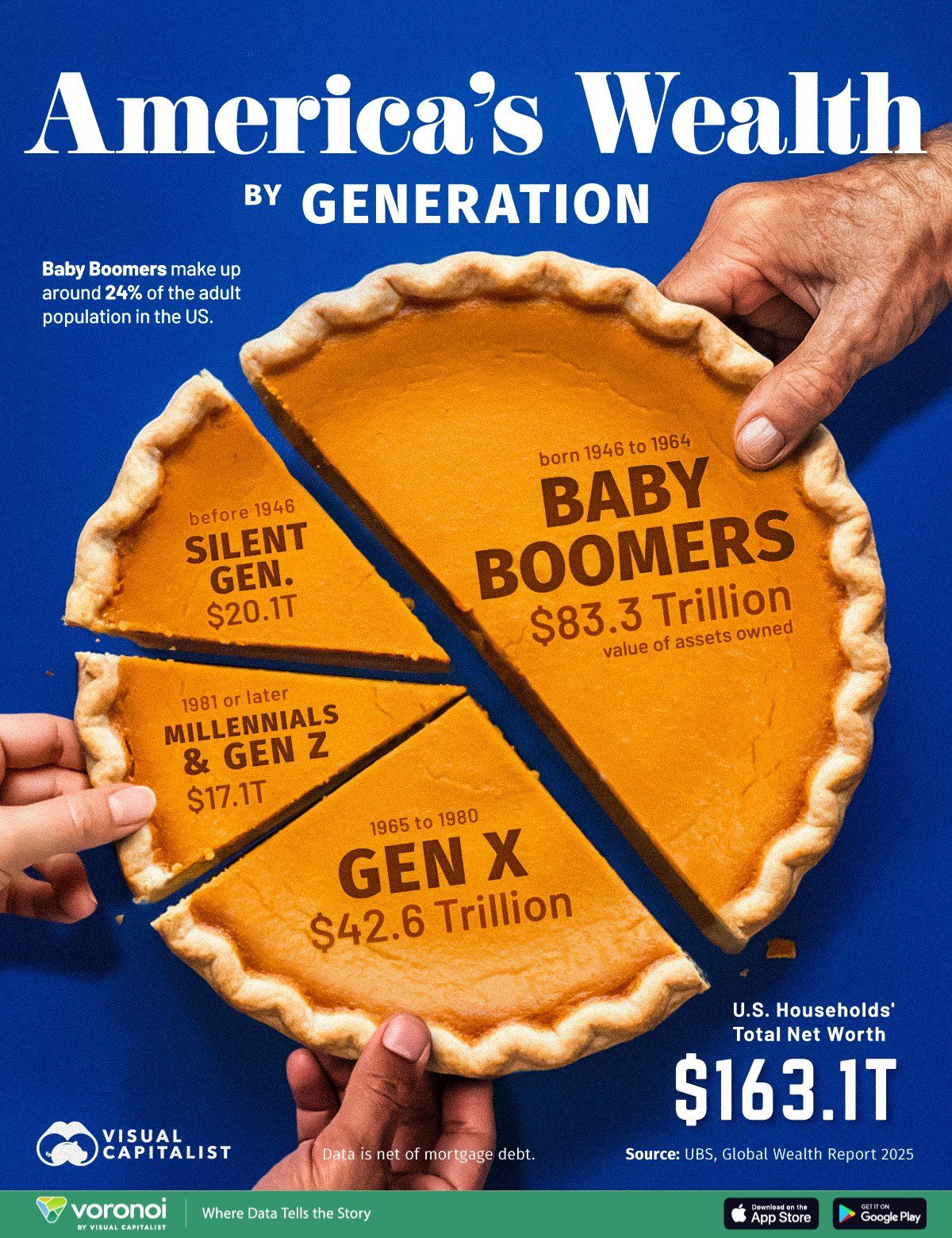

Visualizing America’s wealth distribution by generation, Baby Boomers FTW!

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

The Short Read 📝

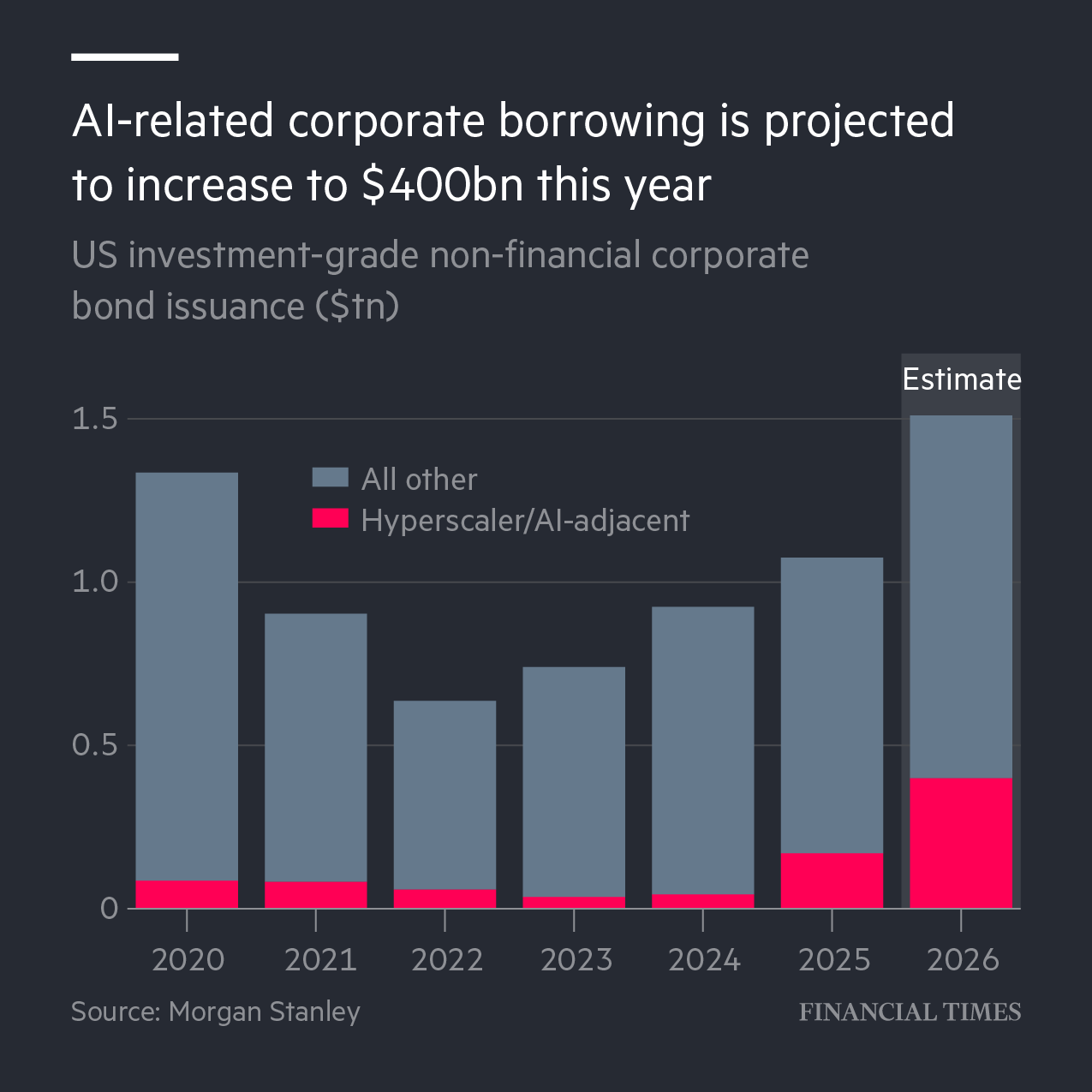

Big Tech companies are on track to dominate borrowing in the US bond market, in a shift that could expose some of the world’s safest securities to greater risk from artificial intelligence.

So far, the main borrowers have been large banks and telecom companies. This means that credit investors haven't been too affected by changes in the tech-heavy stock market. However, investors are worried that the large spending on AI, compared to the returns it brings, might create a bubble. This could eventually impact both stocks and the credit market. Read more…

The Long Read 📜

China’s Demographic Crisis and the Return to 400 Million - by Prof. Zhang Junni

China is facing a serious population problem that needs quick action. If nothing is done, the country's population could drop to about 400 million in 83 years, similar to what it was in the early 1900s. The birth rate has fallen sharply from 1.3 to 1.01 in just three years, a change that took South Korea 17 years. This rapid decline shows that there are big issues. The effects are more than just fewer people. With fewer young workers, it will be harder for China to innovate, its economy could suffer, and it might lose its strong position as a major global market.

Zhang Junni, a statistician from Peking University, believes that traditional financial incentives are not enough. South Korea's example shows that giving money doesn't work if social issues remain, like rigid job practices, unequal caregiving roles between genders, and intense competition in education. Zhang suggests a major change: reduce pressure in education, delay decisions after the Gaokao exam, and encourage private business growth. Most controversially, she supports planning for immigration, which is politically sensitive but important. Read more…

Write like a founder, faster

When the calendar is full, fast, clear comms matter. Wispr Flow lets founders dictate high-quality investor notes, hiring messages, and daily rundowns and get paste-ready writing instantly. It keeps your voice and the nuance you rely on for strategic messages while removing filler and cleaning punctuation. Save repeated snippets to scale consistent leadership communications. Works across Mac, Windows, and iPhone. Try Wispr Flow for founders.

That’s all for this week. If you enjoyed this edition, we’d really appreciate if you shared it with a friend, family member or colleague.

We’ll be back in your inbox 2 PM IST next Wednesday. Till then, have a productive week!

Disclaimer: The views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group or individual.