Salutations, Olio aficionados! 👋

Welcome to the 148th edition of Weekly Olio. We’re thrilled to introduce a fresh new twist to your Sundays: Publisher Parmesan, our hand-picked, thoughtfully crafted edition designed to spark inspiration and insights for the week ahead.

It’s the perfect way to unwind, recharge, and prepare for the week with something truly worth savoring.

If you’re new here and you’re looking for more long-form, crispy writing, click the link to subscribe under this GIF 👇

A word from our Sponsors…

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

The Gensol and BluSmart Saga: A Deep Dive into Alleged Fraud, EV Hype, and Investor Shock

On the surface, Gensol Engineering looked like a rising star in India's clean energy revolution. From solar consulting to electric vehicle leasing, and eventually announcing plans to manufacture EVs, it had all the right buzzwords. But peel back the layers, and what emerges is a story that now reads like a corporate thriller—complete with falsified documents, alleged fund siphoning, and suspicious luxury purchases. And all of it is now under the scrutiny of India’s market regulator, SEBI.

Gensol began as a solar consultancy firm, gradually expanding into engineering, procurement, and construction (EPC) services in the renewable energy sector. But its big move came when it jumped into electric vehicle (EV) leasing, claiming to own many of the EV cabs operating under the BluSmart brand. BluSmart, a ride-hailing service positioned as a green alternative to Uber and Ola, was co-founded by the same brothers who led Gensol—Anmol Singh Jaggi and Punit Singh Jaggi.

As Gensol’s ambitions grew, so did its numbers. Revenues soared from ₹61 crore in 2017 to over ₹1,100 crore (~$140 Mn) in 2024. This growth story caught the attention of retail investors. When Gensol listed on the BSE SME platform in 2019, it had only 155 shareholders. By March 2024, that number had swelled to nearly 1.1 lakh investors.

But behind the scenes, the Jaggi brothers were quietly reducing their stake—from over 70% to just about 35%. Then came the first red flag: In March 2024, rating agencies CARE and ICRA downgraded Gensol’s credit rating to 'D'—signaling default.

The Tipping Point: Suspected Falsification and SEBI Steps In

While a credit downgrade alone isn’t unheard of, ICRA’s accompanying note hinted at something more serious—alleged falsification of Gensol’s debt servicing records. In response, CEO Anmol Jaggi denied wrongdoing, citing a temporary liquidity mismatch. But this didn’t calm investor nerves. Gensol's stock began to tank, losing about half its value.

SEBI, which had already received a complaint in mid-2023 about possible price manipulation and fund misuse, intensified its investigation following the credit downgrade.

According to SEBI’s interim order, Gensol took loans worth ₹978 crore from two public sector lenders—PFC and REC—to procure 6,400 EVs. These were to be leased to BluSmart. But SEBI found that only 4,700 EVs were actually purchased, leaving 1,700 units unaccounted for.

The Money Trail: Layered Transactions and Luxury Buys

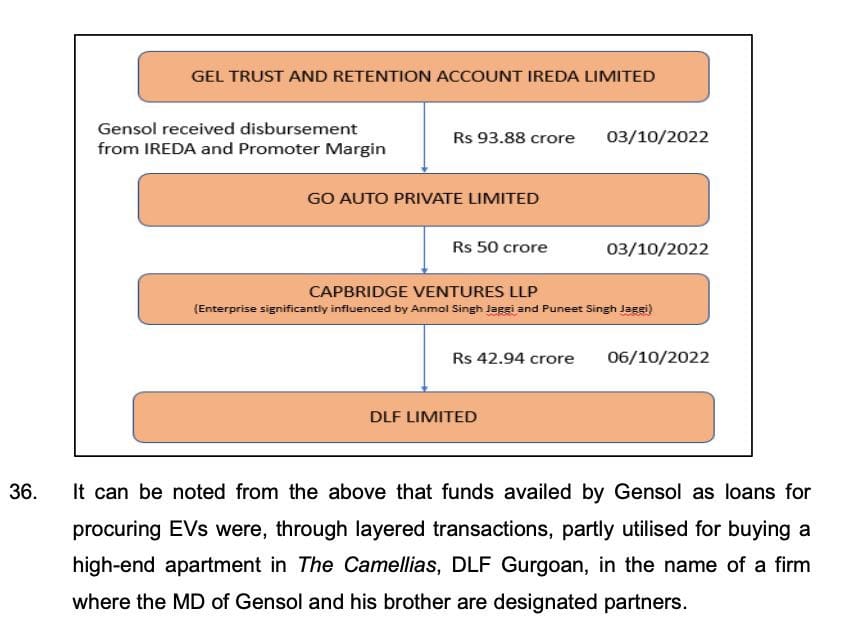

What happened to the missing funds? SEBI’s findings suggest an elaborate financial web. In one instance, Gensol received a ₹71.4 crore loan. Three days later, ₹93.9 crore was transferred to Go Auto, its EV supplier. Go Auto then moved ₹50 crore to Capbridge Ventures LLP—a firm controlled by the Jaggi brothers. Capbridge used ₹42.9 crore to pay for a luxury apartment in a premium Gurgaon development called The Camellias.

Even the ₹5 crore booking amount for the apartment was allegedly paid via company funds, routed through the Jaggis’ mother, who then returned the funds not to Gensol, but to another connected entity.

SEBI’s order outlines several such transactions, suggesting a pattern of funds being moved through shell companies and related entities—ultimately ending up in personal assets or back into Gensol’s stock via brokers.

One such instance involved ₹40 crore going to Valer Solar Industries, from where it found its way to Sharekhan Ltd., and was allegedly used to buy Gensol shares. Personal expenses flagged in the order include a ₹26 lakh golf set, ₹17 lakh spent at a Titan retail store, spa bills, and luxury travel—all funded from company accounts.

EV Numbers Don’t Add Up

Out of the ₹978 crore borrowed, only ₹664 crore was tied directly to the EV procurement plan. Add Gensol’s claimed 20% equity contribution, and the total should have been ₹829 crore. Yet, SEBI found only ₹567 crore actually spent on 4,700 vehicles. That leaves a ₹262 crore gap that investigators believe may have been siphoned off.

SEBI also questioned Gensol’s claims of receiving 30,000 EV pre-orders. Upon investigation, these turned out to be non-binding agreements with no confirmed pricing or timelines.

When NSE officials visited Gensol’s Pune facility, they reportedly found just 2–3 laborers and minimal electricity usage—casting doubt on whether any real EV manufacturing had begun.

The Fallout: SEBI Clamps Down

SEBI has now barred Anmol and Punit Jaggi from holding director or senior managerial roles in Gensol. Both the company and its promoters are prohibited from trading in securities until further notice. A forensic audit has been initiated, with six months given to investigate the financial dealings of Gensol and its affiliates.

This saga also raises serious questions about oversight at public sector lenders like PFC and REC, which are tasked with promoting India’s renewable energy goals. How did such large sums get disbursed with so little apparent scrutiny?

Lessons for Investors and the Clean Tech Sector

Gensol’s case is a wake-up call for retail investors. While green energy and EVs are exciting growth sectors, headline numbers can often mask deeper problems. Just because a company operates in a buzzy industry doesn’t mean it's beyond scrutiny.

The forensic audit results are now highly anticipated—not just for potential criminal liability, but for what they reveal about governance lapses in one of India’s most hyped sectors. Investors, regulators, and lenders alike will be watching closely.

For India’s EV ambitions to succeed, confidence in the ecosystem is essential. That begins with trust—and trust begins with transparency. Gensol, once seen as a clean tech champion, now finds itself as a cautionary tale.

Interested in understanding the Blusmart journey better? Check out our previous coverage here:

That’s all for this week. If you enjoyed this edition, we’d really appreciate if you shared it with a friend, family member or colleague.

We’ll be back in your inbox 2 PM IST next Sunday. Till then, have a productive week!

Disclaimer: The views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group or individual.