Salutations, Olio aficionados! 👋

Midweek greetings to all, as we unveil the 187th chapter of Weekly Olio—a delightful concoction of laughter, insight, and a sprinkle of mystery. Within these pages, you'll discover a handpicked selection of fascinating finds from the vast realms of the internet.

Keep your eyes peeled for this week’s Publisher’s Parmesan, arriving this Sunday!

A word from our Sponsors…

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

The Quote 💭

“You are young and life is long, and there is time to kill today.

And then one day you find ten years have got behind you.

No one told you when to run. You missed the starting gun.

And you run, and you run, to catch up with the sun, but it’s sinking.”

The Tweet 🐦

In recent years, big companies have been keeping more cash on hand. Publicly traded companies in the US now hold about 5% of their market value in cash. From 1970 to 2000, cash made up 5.8% of their total assets, but from 2001 to 2024, this has grown to nearly 10%. This trend is happening across tech companies, manufacturing firms, and IT service providers.

The Infographic 💹

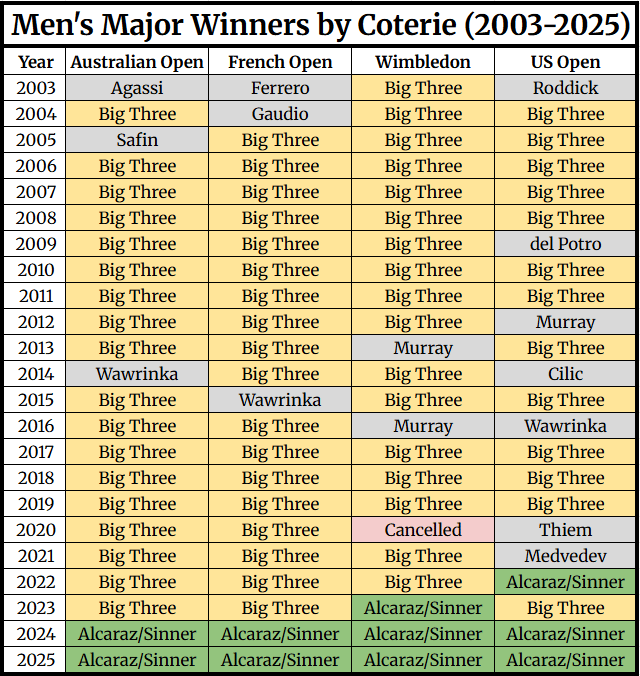

In the 2000s, the Big Three dominated tennis Grand Slams, winning almost all the finals. Since 2023, things have changed. Federer and Nadal have retired, but Djokovic is still playing well. At the same time, new players like Alcaraz and Sinner are becoming prominent. In the last two years, every final has included these two. Will they dominate the 2020s and 2030s like the Big Three did before? We'll have to wait and see.

CTV ads made easy: Black Friday edition

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting — plus creative upscaling tools that transform existing assets into CTV-ready video ads. Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

The Short Read 📝

The Lamentable Decline of Reading - by Financial Times

Fewer people worldwide are reading books, newspapers, or magazines for fun, with only 16% of Americans reading daily compared to 28% twenty years ago. Social media and short videos are replacing traditional reading. However, those who do read are spending more time on it, boosting the publishing industry, as seen with a 5% increase in UK book sales and growth in stores like Waterstones. The main challenge is engaging non-readers, starting young with support from parents and school libraries, though many schools in poorer UK areas lack libraries.

Public libraries are crucial but face funding cuts, with U.S. federal support ended under Trump. Some countries, like Denmark, are removing barriers by scrapping book VAT. While government and industry efforts help, reversing the decline needs a cultural shift. Encouragingly, some young people are turning from social media to reading, offering hope for revival. Read more…

The Long Read 📜

The Impact of Intangibles on Base Rates - by Morgan Stanley

This article examines the increasing importance of intangible assets in company valuations and their impact on financial forecasting base rates. Forecasts are typically made using both narrative-based projections and statistical base rates. While base rates serve as useful benchmarks, they must adapt to changing realities. Leading companies often rely on intangible assets like software and intellectual property, which differ from tangible assets. Therefore, it's crucial to understand their impact and adjust base rates accordingly.

The key lessons: investors must adapt base rate thinking to reflect intangible-driven shifts, and opportunities lie in identifying firms positioned to outperform historical norms while avoiding those prone to rapid decline. Read more…

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

That’s all for this week. If you enjoyed this edition, we’d really appreciate if you shared it with a friend, family member or colleague.

We’ll be back in your inbox 2 PM IST next Wednesday. Till then, have a productive week!

Disclaimer: The views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group or individual.