Salutations, Olio aficionados! 👋

Midweek greetings to all, as we unveil the 205th chapter of Weekly Olio—a delightful concoction of laughter, insight, and a sprinkle of mystery. Within these pages, you'll discover a handpicked selection of fascinating finds from the vast realms of the internet.

Keep your eyes peeled for this week’s Publisher’s Parmesan, arriving this Sunday!

A word from our Sponsors…

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

The Quote 💭

“A common mistake that people make when trying to design something completely foolproof is to underestimate the ingenuity of complete fools.”

The Tweet 🐦

Have you heard of relationship compounding? If not, this is a great thread with an essay on what is relationship compounding and how to use it for your benefit.

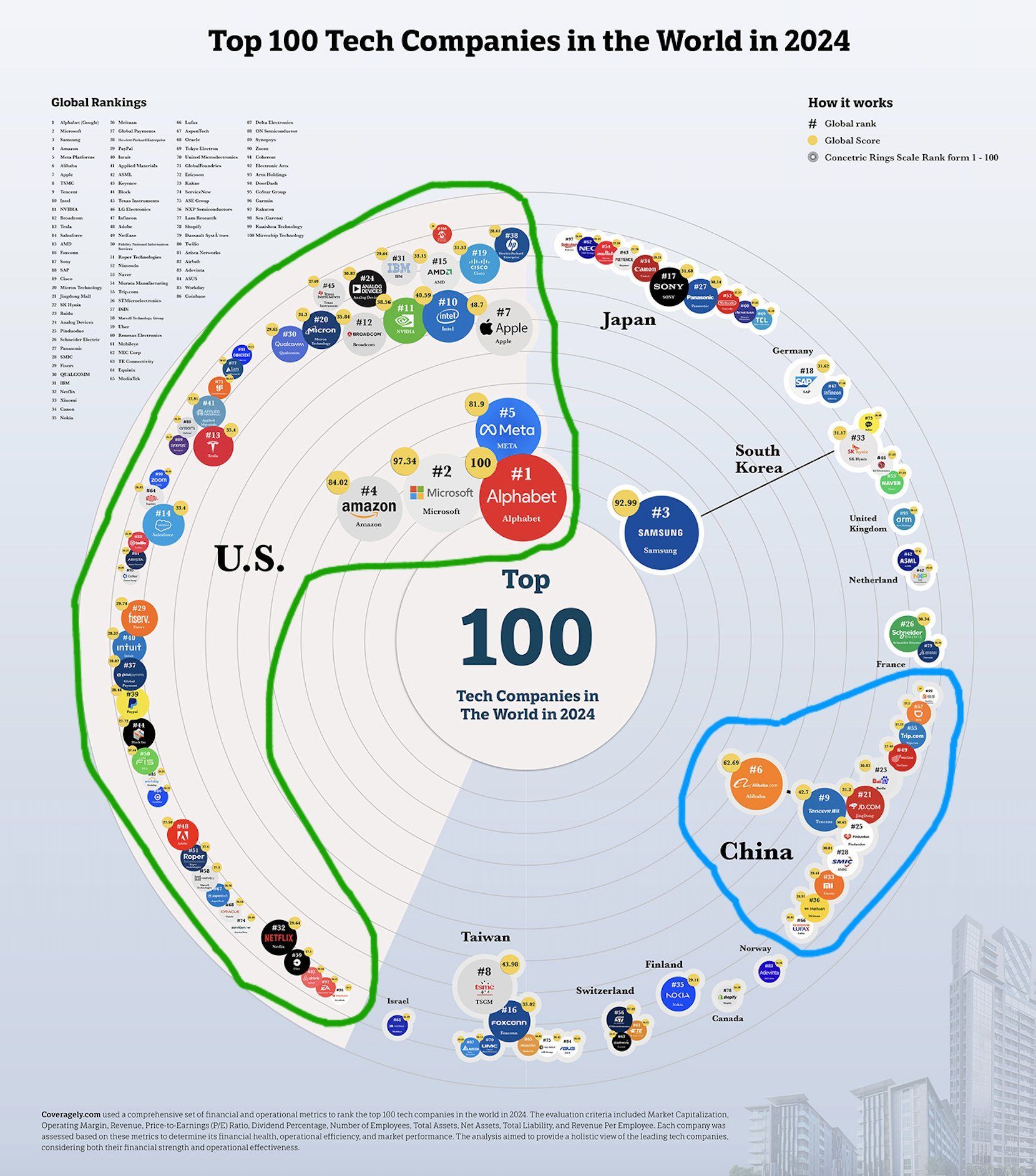

The Infographic 💹

This is a fun way to show that US companies are very dominant in the tech space.

What do Carlyle, Blackstone, and KKR all have in common?

Leaders from Carlyle, Blackstone, and KKR are among the guest speakers in the Wharton Online + Wall Street Prep PE Certificate Program.

Over 8 weeks, you will:

Learn directly from Wharton faculty

Get hands-on training with insights from top firms

Earn a respected certificate upon successful completion

Save $300 with code SAVE300 at checkout + $200 with early enrollment by January 12.

Program starts February 9.

The Short Read 📝

Long Degeneracy - by Jez

“Long degeneracy” is the author’s term for a mindset: believing the future will be ever more speculative, broken, tribal and weird. The driving force? As real, safe returns collapse, people chase far more risk. The article points to high inequality, overpriced housing and stagnant wages as key enablers of this mentality.

With the traditional path of education ➜ job ➜ home ownership increasingly blocked, the only alternative in many minds is hyper-gambling — crypto, options, sports-betting, meme stocks. The author argues that digital tools only hasten the shift: attention spans shrink, communities move online, and short-term upside becomes the new normal while effort and time become devalued. In the short term this looks like booming speculation and shrinking savings; in the long term it’s about broken reward systems, widening gaps between winners and losers, and a world where being part of “the house” becomes the only safe play. Read more…

The Long Read 📜

The Indian Consumer at 2030 - by Fireside Ventures

The Indian consumer is evolving rapidly. This report from Fireside Ventures, a consumer focussed venture capital firms, does a good job of capturing the shift that is underway. India had always been a general trade country - with the local grocery stores owning the customers and influencing purchase decisions. General trade continues to decline as e-commerce, quick commerce, and D2C scale rapidly. By 2030, India will have 1.1B internet users and 400M online shoppers, creating a flat awareness landscape between metros and Bharat.

Consumption will be driven by 13 major shifts: equal aspirations but uneven access, the rise of experiential spending, women as primary decision-makers, health and fitness becoming status symbols, dining out as a social ritual, sports as a family investment, AI-led personalization, and kids becoming a major wallet. Across categories, the next decade belongs to bold, niche, India-first brands built for digital-native, experience-seeking consumers. If you are someone who is looking to understand how the Indian consumer landscape will evolve, this report is a must read. Read more…

The world’s biggest brands turn to TerraCycle

TerraCycle recycles what others won’t, and they make it profitable. It’s why hundreds of brands partner with them to recycle everything from coffee pods to used baby car seats to razors. And they made $45M last year doing it. Share in their growth potential and get 15% bonus stock.

This is a paid advertisement for TerraCycle’s Regulation CF offering. Please read the offering circular at https://invest.terracycle.com/

That’s all for this week. If you enjoyed this edition, we’d really appreciate if you shared it with a friend, family member or colleague.

We’ll be back in your inbox 2 PM IST next Wednesday. Till then, have a productive week!

Disclaimer: The views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group or individual.