Salutations, Olio aficionados! 👋

Welcome to the 160th edition of Weekly Olio. We’re thrilled to introduce a fresh new twist to your Sundays: Publisher Parmesan, our hand-picked, thoughtfully crafted edition designed to spark inspiration and insights for the week ahead.

It’s the perfect way to unwind, recharge, and prepare for the week with something truly worth savoring.

If you’re new here and you’re looking for more long-form, crispy writing, click the link to subscribe under this GIF 👇

A word from our Sponsors…

You’ve never experienced business news like this.

Morning Brew delivers business news the way busy professionals want it — quick, clear, and written like a human.

No jargon. No endless paragraphs. Just the day’s most important stories, with a dash of personality that makes them surprisingly fun to read.

No matter your industry, Morning Brew’s daily email keeps you up to speed on the news shaping your career and life—in a way you’ll actually enjoy.

Best part? It’s 100% free. Sign up in 15 seconds, and if you end up missing the long, drawn-out articles of traditional business media, you can always go back.

Xiaomi’s Big EV Bet: Sleek Cars, Smart Tech, and a Wake-Up Call

A few weeks ago, tragedy struck in China. Three university students, riding in a Xiaomi SU7 electric vehicle, died after their car—reportedly operating under autonomous mode—swerved and crashed into a concrete barrier at 97 km/h. The car caught fire. The details are still under investigation, but the incident triggered an intense debate: Are EVs being pushed out too fast? Is autonomous driving as safe as it’s marketed to be? And where does responsibility lie—tech companies, regulators, or users?

In this moment of scrutiny, Xiaomi finds itself in the spotlight—not just as a tech company launching a car, but as a representative of a broader shift in how we think about cars themselves.

In March 2024, Xiaomi launched its first EV—the SU7. The launch was, by all business standards, a massive success. Within a year, Xiaomi sold close to 200,000 units. In a single month, it sold more than 29,000. Not bad for a company known more for phones and fitness bands than torque and tire specs.

But Xiaomi’s founder, Lei Jun, made it clear: this wasn’t just a side hustle. He called the SU7 his “last major venture” and committed himself fully to it. The car, with a design echoing Porsche’s Taycan, was marketed as a sleek, performance-first, software-forward vehicle. And priced to target China’s growing middle class.

Why did it work? Partly because Lei Jun and Xiaomi have cultivated something that most car companies lack—fan culture. Before launch, Lei ran surveys on Weibo. A staggering 97% of his followers supported Xiaomi entering the EV game. He leaned into this loyalty, and it paid off.

EV vs ICE: Mindsets and Design Philosophies

One key reason for Xiaomi’s strong debut may be how it approached the vehicle—not as an upgrade to the traditional car, but as a new kind of smart device.

Traditional auto manufacturers tend to think: “How do we add a computer to a car?” Tech companies flip that script: “How do we turn a computer into a car?”

That mindset leads to different design choices. Touchscreens. OTA updates. Sleek, minimalist interiors. A focus on UX, not just horsepower. Xiaomi leaned into this. From the UI to the infotainment, SU7 feels like a phone on wheels.

It’s not alone. Companies like Nio, Xpeng, and even Huawei are bringing similar thinking to China’s increasingly saturated EV market. But Xiaomi’s sheer brand recognition—especially among younger consumers—gave it an edge.

The Shadow Over the Road

But then came the crash.

While facts are still emerging, online speculation exploded. Some claimed the vehicle doors couldn’t be opened after the fire started. Others suggested driver error after the autonomous mode disengaged. A sharp swerve, a loss of control, and a fatal impact.

Autonomous driving was meant to be a safety feature. Yet, it raises a new kind of risk—complacency. Especially among younger, less experienced drivers. If your first car drives itself, how do you learn to react in emergencies?

Most EV makers insist that their autonomous features require hands-on-the-wheel attention. But that’s often buried in fine print. The headline? “Smart driving.” And in a TikTok-fed world of rapid impressions, that’s what sticks.

This is where the responsibilities blur.

Manufacturers want to push features that sell. Regulators are catching up to a new wave of vehicle tech. And consumers—especially digital natives—are often too trusting.

Are EVs More Dangerous?

Let’s be clear: fires and accidents happen with all cars. But battery-powered EVs come with unique risks. When a lithium-ion battery catches fire, it’s not something a bucket of water can fix. These fires are harder to extinguish and can spread faster.

More than that, the sheer speed of EV development in China—sometimes viewed as a badge of innovation—is also becoming a concern. Companies push out new models at a staggering pace. But skeptics are asking: what corners are being cut?

To their credit, many automakers, including Xiaomi, have tried to be more transparent. Some even live-stream parts of their manufacturing processes. And quality checks, mandated by the state, are routine in Chinese EV plants.

But the optics of a three-year design-to-launch cycle (especially compared to Apple's 10-year non-starter of a car project) naturally spark doubts. Are these smart devices wrapped in metal—or fully tested road machines?

10x Your Outbound With Our AI BDR

Scaling fast but need more support? Our AI BDR Ava enables you to grow your team without increasing headcount.

Ava operates within the Artisan platform, which consolidates every tool you need for outbound:

300M+ High-Quality B2B Prospects, including E-Commerce and Local Business Leads

Automated Lead Enrichment With 10+ Data Sources

Full Email Deliverability Management

Multi-Channel Outreach Across Email & LinkedIn

Human-Level Personalization

The Competition Landscape: Why Xiaomi Still Has a Shot

Despite the scrutiny, Xiaomi’s car project is far from a flop. Its brand, price point, and tech-first approach give it clear advantages in a market that’s still expanding.

It’s also positioned uniquely.

BYD, China’s EV juggernaut, has scale. It sells half a million cars a month and dominates in price and production efficiency. But not everyone wants a BYD. Xiaomi is aiming for those who want a lifestyle car. A phone brand loyalist. A younger driver. Someone who values design and connectivity as much as range.

It’s a smart niche strategy in a market where even a “niche” could mean millions of units sold.

What's Next for Xiaomi—and for EVs in China?

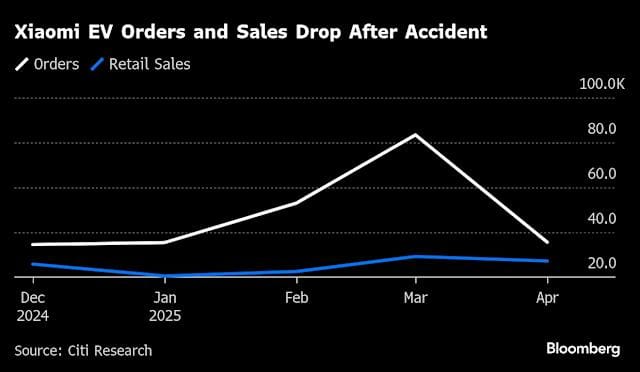

Lei Jun isn’t stopping at the SU7. More models are coming, including higher-end configurations. But the road ahead will be more closely watched now. The recent crash forced Xiaomi—and the EV industry as a whole—into the uncomfortable spotlight of accountability.

China’s regulators will likely demand stricter testing. Consumers may start asking more questions about what “autonomous” really means. And brands, especially newcomers like Xiaomi, will need to be more transparent—not just flashy.

Ultimately, EVs aren’t going away. They’re the future. But the industry is learning in real time that when you take smart tech and put it on the road, the stakes are literally life and death.

The next few years will test how well these companies—not just Xiaomi—can balance ambition with responsibility.

Because moving fast and breaking things? That might work in apps. Not in cars.

StartEngine’s $30M Surge — Own a Piece Before June 26

StartEngine is the investing platform providing exposure to pre-IPO companies like OpenAI, Perplexity, and Databricks.

After doubling their revenues YoY in 2024 ($23M to $48M), StartEngine’s now tripled first quarter revenue YoY to a record $30M, based on its unaudited Q1 2025 financials. Now you can join 45K+ shareholders across all offerings before this round closes next month.

Reg A+ via StartEngine Crowdfunding, Inc. No BD/intermediary involved. Investment is speculative, illiquid & high risk. See OC and Risks on page.

That’s all for this week. If you enjoyed this edition, we’d really appreciate if you shared it with a friend, family member or colleague.

We’ll be back in your inbox 2 PM IST next Sunday. Till then, have a productive week!

Disclaimer: The views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group or individual.