Salutations, Olio aficionados! 👋

Welcome to the 210th edition of Weekly Olio. We’re thrilled to introduce a fresh new twist to your Sundays: Publisher Parmesan, our hand-picked, thoughtfully crafted edition designed to spark inspiration and insights for the week ahead.

It’s the perfect way to unwind, recharge, and prepare for the week with something truly worth savoring.

If you’re new here and you’re looking for more long-form, crispy writing, click the link to subscribe under this GIF 👇

A word from our Sponsors…

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

When the AI Fever Breaks, Where Does the Money Go? SoftBank, Nvidia, and the Quiet Bet on India

If you spent any time on trading floors this year, you’d swear you were watching a video game on fast-forward. Screens glowing green, numbers blurring, indexes behaving as if gravity had been temporarily switched off. Every few weeks, another all-time high. Nvidia — once a niche graphics-chip maker — is now flirting with a $5 trillion valuation, a number that not too long ago sounded unrealistic for any semiconductor firm.

This is the AI century, investors declared. Chips, servers, and machine-learning dreams are supposed to reshape everything from healthcare to diplomacy to grocery shopping. It’s a familiar feeling — innovation mixed with euphoria, the kind markets experience once every generation. The kind that usually ends with a cold shower.

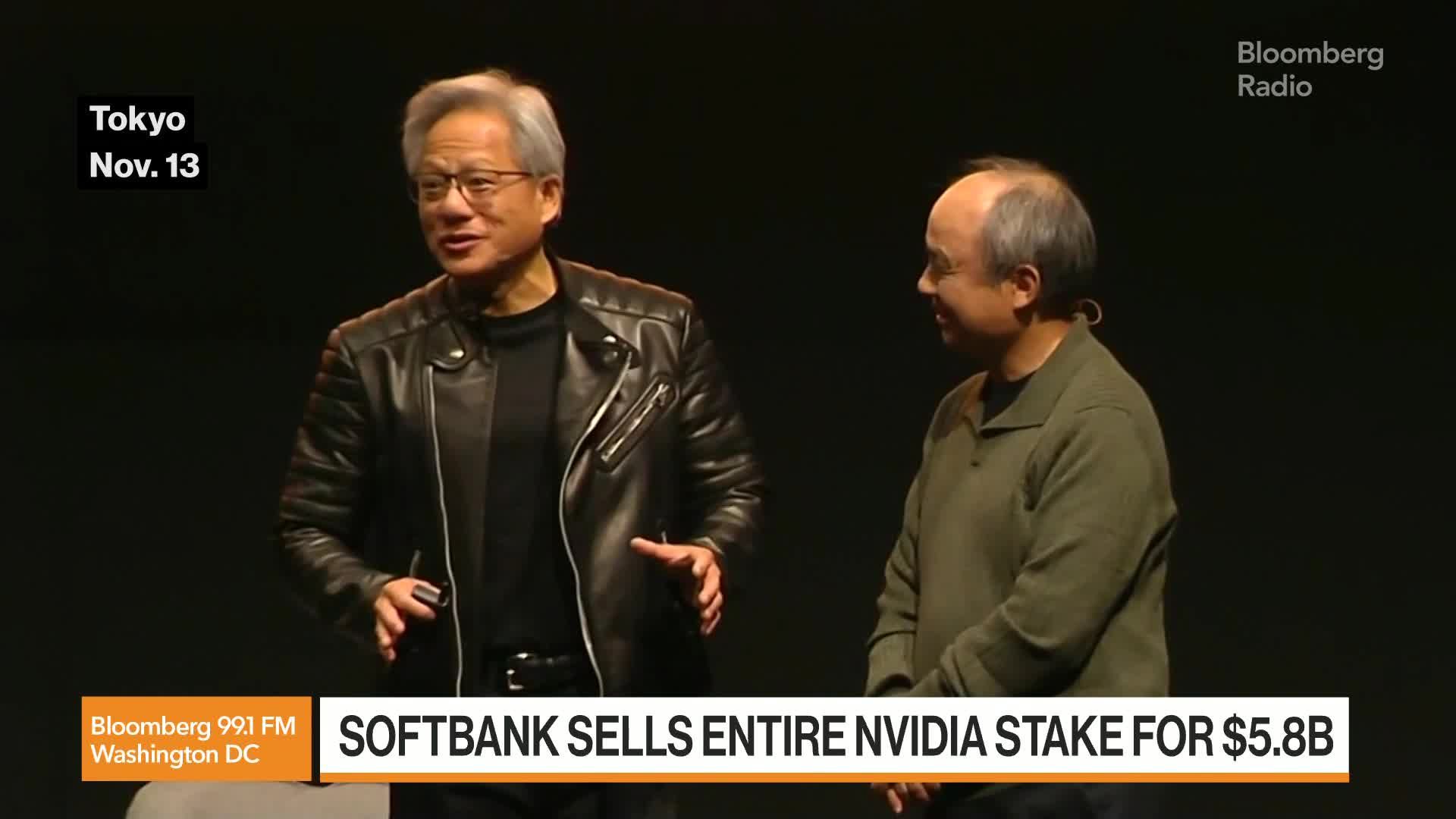

And then, a few days ago, came an unexpected headline: SoftBank sold its stake in Nvidia, pocketing nearly $6 billion.

For a moment, the market blinked. SoftBank — the investor whose bets shaped the last technology cycle — was stepping back from the AI hardware frenzy. Had something shifted? Was this the first sign of overheating?

But the quiet twist is this: SoftBank isn’t pulling away from AI. It’s pivoting deeper into it — just not into chips. Instead, it’s placing its money where the next layer of value may lie: AI software, robotics, and platforms that use those chips. It’s not abandoning the race; it’s switching lanes.

And that lane change is exposing a deeper question that’s been simmering beneath the charts: If the AI rally starts to cool, where does all the restless capital go next?

Increasingly, analysts think they know the answer — and it isn’t Silicon Valley or Tokyo. It’s India.

To understand SoftBank’s pivot, you have to zoom out and see the world it’s reacting to. This year’s market performance has been defined by a single theme: AI-driven everything. A handful of tech giants — the “Magnificent 7” — have added trillions to global market cap.

Bloomberg estimates that two-thirds of the S&P 500’s gains in 2025 came from just these seven companies.

That level of concentration makes history buffs nervous. It feels like the late 1990s again, when too few stocks captured too much imagination. Or like 2021, when crypto valuations floated far above fundamentals.

Nvidia became the poster child of this concentration. As demand for AI chips skyrocketed across model developers and data-center operators, its earnings surged — and so did expectations. When enthusiasm moves faster than revenue, even a great company starts to look like a risky bet.

That’s the backdrop against which SoftBank sold its Nvidia stake. Not as a retreat, but as a rebalancing. It wants liquidity to chase the next frontier: AI platforms, robotics, and model developers.

And here’s the part many missed: Nvidia and OpenAI are now building 10 gigawatts of Nvidia-powered data center capacity — a project worth roughly $100 billion. The fundamentals behind AI aren’t going away. The infrastructure race is still accelerating.

So we have two realities coexisting:

The AI boom is real. Companies are throwing mind-boggling sums at hardware, models, and compute.

The market around that boom looks overheated. Prices moving too fast, based on too few names.

Economists have started whispering an uncomfortable phrase again: bubble risk. Not certainty — but the conditions are there. Which leads to the next question: If the air starts thinning at the top, where does the money rotate?

The Slow, Steady Market Everyone’s Suddenly Looking At

A Bloomberg note earlier this month pointed to a surprising candidate: India. Not because it’s riding the AI wave. But because it isn’t. In a year when capital chased a handful of hyper-growth AI stocks, India’s market was almost boring — and that’s exactly why strategists find it attractive.

India’s rally has been driven by:

Domestic demand

Infrastructure spending

Manufacturing

Steady earnings in banks, energy, and capital goods

Nothing speculative. Nothing euphoric. No Indian equivalent of Nvidia distorting valuations. In fact, the absence of a homegrown AI giant has insulated India from AI mania. Analysts at Macquarie and HSBC have both argued the same thing:

India’s growth story is structural, not speculative. Which is precisely what global investors rediscover every time they want to de-risk.

If the AI trade unwinds, here’s what is likely:

Global investors rotate from overheated tech indexes to emerging markets with dependable fundamentals. India tops that list.

AI application companies in India — the “applied AI economy” — become attractive to both VCs and corporates. Not model-building, but model-using.

Strategic investors look for scalable markets where AI tools can be deployed cheaply and widely. India is almost tailor-made for that transition.

In other words, India becomes a safe harbor — not because of AI hype, but because of everything that sits underneath it. But there is a counterweight to this optimism.

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop, but people still drive decisions. Levanta’s research shows affiliate and creator content continues to influence conversions, plus it now shapes the product recommendations AI delivers. Affiliate marketing isn’t being replaced by AI, it’s being amplified.

If India Is the “Next Safe Bet,” It Needs to Earn It

The narrative is appealing: money leaves overheated AI stocks and flows into India. Reality is more complicated. Here’s what India still lacks:

1. Hardware capacity: India is years away from manufacturing high-end AI chips domestically.

2. Energy and data-center infrastructure: AI compute needs stable power and cooling. India is improving, but still inconsistent.

3. Core AI research: India excels at applied AI. But it doesn’t lead in foundational model development.

4. Market risk perception: During global shocks, emerging markets often see outflows first — regardless of fundamentals.

5. Valuation premiums: India’s market already trades at 22–24x forward earnings, which leaves little margin for error.

So yes, India could become the world’s “post-AI-euphoria” stabilizer — but only if it strengthens its physical infrastructure, deepens innovation, and builds a bigger role in global tech supply chains.

Markets don’t reward potential. They reward delivery.

The SoftBank Signal

SoftBank’s sale isn’t a verdict against AI. It’s a sign that the first chapter — chips, hardware, data centers — may be peaking. The next chapter — scale, applications, deployment — is where the real battle begins.

And that battle will play out in markets where AI is a tool, not a deity. Markets where real economic work still drives valuations. Markets like India.

The irony is striking: A tech boom so powerful that it pushed valuations into the stratosphere may end up sending capital toward the one large market that stayed grounded.

If the AI fever breaks, India won’t be the consolation prize. It might be the next story.

Interested in learning more about AI? Check out our previous coverage here:

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

That’s all for this week. If you enjoyed this edition, we’d really appreciate if you shared it with a friend, family member or colleague.

We’ll be back in your inbox 2 PM IST next Sunday. Till then, have a productive week!

Disclaimer: The views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group or individual.